“People First” Approach

While there are lots of factors that impact investment results – sector, customer, supplier, etc. dynamics – we at Boyne believe one of the most important drivers of success or failure is a company’s management team. If that is the case, why do so many private equity firms focus on items such as accounting and legal support, but outsource their human capital? Boyne prioritizes human capital as a core competency, and we have a full-time staff to support our portfolio companies’ management teams.

This investment in our team provides significant operational “lift” to our management teams as Boyne’s team seeks to generate 1) better candidates (including both fit and capabilities), 2) faster fill-time for positions, 3) better retention in the long-term and 4) better economics (no charge for our portfolio companies).

Structurally Different Approach to Human Capital

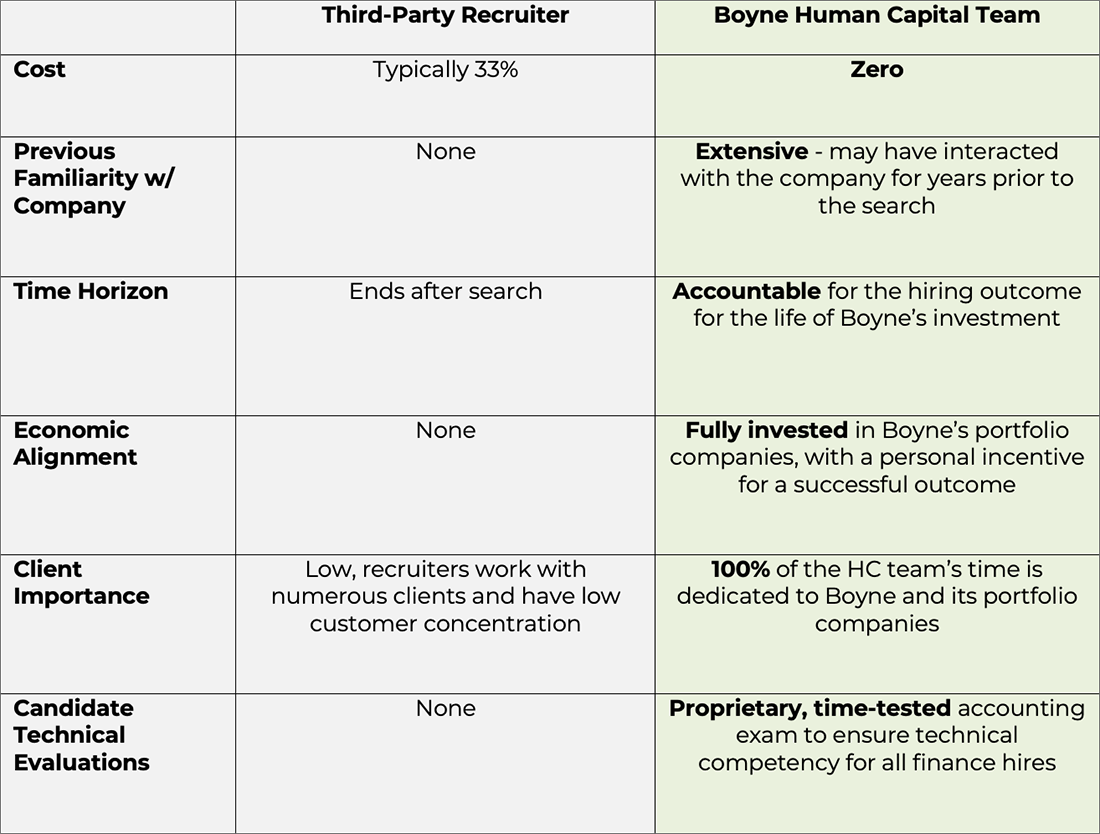

Our higher success rates stem from structural differences for candidates compared to third-party recruiters:

- Intimate Knowledge of the Company: Our human capital team is intertwined with our deal and operations team, and may know the Company for years before a search is even initiated. This knowledge of each company’s operations and culture ensures the right candidate fit.

- Personal Investment: Our human capital team is personally invested in all of our portfolio companies, and thus aligned with the long-term success of the business, and not by a near-term placement fee.

- Long-Term Lens: Our human capital team is evaluated by the long-term success and retention of the candidates, not near-term placement, further incentivizing taking the extra time for the perfect candidate, vs. filling a position and getting a fee.

- No Cost to the Company: Boyne has invested in our human capital team as a cost-center because this investment generates an attractive return through the eventual success of our equity investment. We do not charge these services back to our portfolio companies.

- Efficient With Management Time: Our team will screen and interview thousands of candidates a year. When a vetted candidate is presented to the portfolio company, the offer to acceptance rate is over 90%.

Advantages of Boyne’s In-House Human Capital Team

How We Work

Boyne’s Human Capital team focuses on hiring C-Suite roles such as CFO, COO, CIO, VP Sales/Marketing, etc., placing over 20 portfolio company executives annually.

Our in-house team removes the hiring burden from CEOs and management teams, so they can focus on running their businesses. We manage the entire preparation, sourcing, and screening process, including building job profiles, market research, customized candidate evaluation scorecards, and sourcing strategies.

Our recruiters then conduct initial interviews, PI evaluations, assessments, case studies, and reference checks. This comprehensive vetting process ensures that candidates are thoroughly screened and meet all specified criteria when they are presented to the CEO.